9 Chapter 9: When Things Go Wrong / Service Recovery

Learning Objectives

LEARNING GOALS

Upon completion of this chapter, you should understand:

- Service recovery — what it is and how to accomplish it.

- The five steps to customer service recovery.

The preceding chapters of this book discuss in detail how to build a relationship with a client. In almost any relationship, there can and will be challenges, and the advisor-client relationship is no different. The good news is, much of what we have learned about building relationships can also be applied to situations where something did not go according to plan.

According to Small Business Trends, acquiring a new client can cost five times more than retaining an existing client, and it costs sixteen times more to bring a new client up to the same level as a current client (Mansfield, 2016). Preserving client relationships is critical to both the financial advisor and their employers. It is common sense that significant effort is applied to recover a customer when things go wrong.

What is Service Recovery?

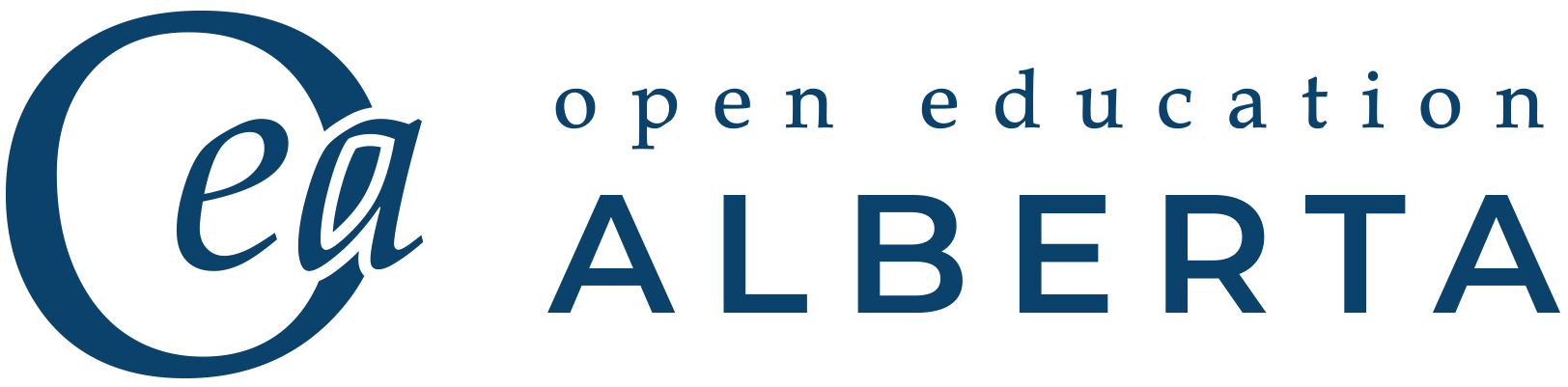

Service recovery involves making things right with a client when an error or problem has occurred, and it is critical to react quickly to correct whatever has gone badly. The goal with service recovery is to regain the loyalty and trust of the client. When the problem is handled promptly and properly, and trust is restored with the client, the connection between advisor and client can be even stronger than it was before.

Figure 8.1 shows the what happens to customer loyalty when service recovery is successful, as opposed to when service recovery fails.

Customer Service Recovery

Image generated using the prompt “Generate an Image depicting the Customer Service Recovery Method,” sourced from OpenAI, 2025.

Step 1: Apologize

-

I’m sorry – When someone says “I’m sorry”, this describes the person and their state of being.

-

I apologize – When someone says “I apologize”, they are apologizing for a situation or an occurrence.

-

I have failed.

-

I am to blame.

-

I am not a good person.

-

I am not a professional.

-

acknowledge the client’s feelings

-

empathize that a problem does exist (even if it is just from the client’s perception)

-

express to the client that you share responsibility for the problem

-

convey sincerity

-

ask for the opportunity to correct the problem.

Image generated using the prompt “Generate an Image showing the Advisor apologizing to Mr. Pederson,” sourced from OpenAI, 2025.

Step 2: Empathy and Respect

In earlier chapters, we looked at empathy, and why it is a vital part of client conversations. Empathy is especially important when attempting to recover a client. As a reminder, empathy is the ability to understand and share the feelings of others.

Respect is also critical during client recovery. Respect means having due regard for the feelings, wishes, rights or traditions of others (Oxford University Press, 2022). A client may present with a problem or concern that is incorrect, not the fault of the financial institution or even of their own making. Being able to show respect to a client who is upset and putting all blame on you, as you are the representative of the institution, can be challenging. Remaining professional and showing respect allows you to offer the client consideration for their current situation.

Active listening means giving clients your full attention and making them feel heard. Let them speak without interrupting, even if they are mistaken. Stay focused and avoid distractions. Use calm body language and maintain eye contact if appropriate.

When they finish, rephrase their concerns to confirm understanding:

“If I understand you correctly, you’re concerned that…”

Avoid sounding defensive. Stay calm and professional — your response should show that their issue matters.

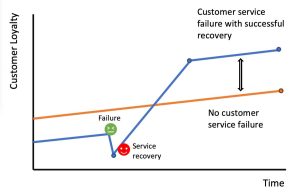

How exactly is the Advisor in this image showing Mr. Pederson empathy and respect?

The advisor clearly demonstrates both empathy and respect through his body language and facial expression. His posture is slightly leaning forward, which indicates attentiveness and engagement. He is making direct eye contact with the client, a non-verbal cue that shows he is focused, present, and valuing the client’s concerns.

His facial expression is calm and sincere, signaling genuine concern and understanding. The open hand gesture reinforces his willingness to listen and work collaboratively toward a solution. By not interrupting and maintaining a composed demeanor, the advisor fosters an environment where the client feels safe and respected. This helps defuse emotional tension and reassures the client that their issue is being taken seriously.

This kind of approach not only promotes trust but also strengthens the advisor-client relationship—key to successful service recovery and long-term client retention.

Step 3: Analyze the Situation / What is the Root of the Problem?

The phrasing you use can be integral to placating an irate customer. Phrases that may sound perfectly fine to you can cause the customer to become even more irritated, while others can help to appease and inform them. Review the examples provided below to see what phrases to avoid and which phases to employee when dealing with an angry client.

|

I am sorry, but… |

We apologize for the inconvenience. |

|

We can’t do that. |

I can’t help you. |

|

I have no record of your account. |

What seems to be the problem? |

|

I don’t know. |

I already answered that. |

|

It’s not my/our fault |

Calm down. |

|

That’s against our policy. |

It’s not my job/problem. |

|

Can I put on hold? |

Visit our help center. |

|

Why didn’t you just… |

We can’t help you with that right now… |

|

“No” at the beginning of a statement. |

You’re mistaken |

|

To be honest… |

With all due respect… |

Instead, try to incorporate the following:

|

The best way to handle that is… |

The fastest way to get that done is… |

|

I will find a way to solve… |

I can help… |

|

Consider it done! |

I can definitely do that for you! |

|

You’re right! |

Thank you for bringing this to my attention. |

|

I’m sure we will find a way… |

What I can do for you is… |

|

The easiest way to get that… |

Let’s work together to find a solution. |

|

While I look for your account, how can I help you? |

As an immediate solution, I’d like to suggest… |

|

If I can’t take care of this, I will find out who can. |

You’ve come to the right place to get this resolved. |

|

I would feel frustrated by that too. |

You have a right to be upset. |

“Mr. Hansen, I see the error occurred when your account was set up. The account should have been set up as a no-fee student account, but it wasn’t. Unfortunately, this has led to month-end service charges overdrawing your account, and your insurance company’s payment was returned due to insufficient funds. I will reverse all service charges on the account to ensure this is corrected. I will create a draft for the amount owed to your insurance company and an apology letter will be couriered directly to your insurance company. How does this sound?”

Sometimes, providing the client with a choice of how to resolve their problem is helpful. Giving the client a choice allows them to feel a part of the process and provides them with some opportunity to make decisions. Including the client in the process of determining a solution can also help you see if you are on the right track to recovering the client. If there is still resistance, you may need to backtrack some steps to see what you missed in your discussion. More questions need to be asked, and you will need to probe further to better understand where the root of the problem lies.

Step 4: Offer a Solution

The client feels injured due to the situation they are experiencing. You need to recognize that correcting the problem is only one part of the recovery process. The goal is to ensure the relationship with your client is restored. If a problem/situation has needlessly inconvenienced the client, find something that can be seen as adding value for the client. Doing this shows the client that you want to make it up to them and that you are willing to go above and beyond to make them feel valued. Depending on what authority you have in your position, some things you can do to make the client feel valued are:

- buy the client a beverage while they wait

- offering to waive service charges

- offer to drive to their place of employment with the documents that need signing.

Below are some specific examples of how you could show a client (Mr. Pederson in the examples) that you are willing to go above and beyond.

Image generated using the prompt “Generate an Image showing the Advisor presenting a solution to Mr. Pederson,” sourced from OpenAI, 2025.

To resolve Mr. Pederson’s problem, you would need to reverse the renewal of the investment to ensure that there are no penalties applied on the withdrawal of the investment. Create a money order or a draft to address this issue.

Look at Mr. Pederson’s other investments to ensure that the correct instructions are on file and confirm with those instructions with Mr. Pederson.

What phrases would you AVOID when speaking with Mr. Pederson?

Once you have determined what the actual problem is, it is crucial to seek out any secondary problems the situation may have caused the client. Keep in mind, the client is likely unaware of these secondary problems and may become more upset upon hearing about them. Before explaining these problems to the client, it is best to have solutions in place that to resolve these issues.

For example, another staff member did not set up a client’s new account as a no-fee student account. Service charges that occurred at the end of the month created an overdraft and led to further overdraft and non-sufficient funds (NSF) charges. Before explaining the additional charges to the client, plan to reverse those fees and offer to write apology letters to the individuals or companies where the NSF charges occurred and courier these letters wherever they need to go.

Step 5: Keeping Your Promises and Following-up

It cannot be emphasized enough how important it is to keep your promises and follow through with the agreed upon solution. You need to be realistic about what you can and cannot deliver. Do not say, “I’ll make sure that this never happens again.” As great as this sounds to the client, there is no way one person can guarantee that problems will not happen in the future. Tell your client what you plan to do, and only make promises you know you can keep and are within the scope of your authority.

Once you have resolved the situation, and your client is recovered, do not forget to follow-up with them to confirm they are still satisfied with the solution. It is best to schedule this follow-up in your calendar; a follow-up call or email, a few hours or days after the resolution, shows concern for your client. Plus, it is gives you the opportunity to catch any other issues your client may be facing. Prompt follow-up with the client helps them remember the end of their interaction with you, not the more contentious beginning or middle. Sending the client a thank you note is also a great idea. A thank you note acknowledges that you value their business and invites them to reach out with any future concerns or issues.

Follow-up for Mr. Pederson could look like this:

If you promise to deliver the money order/draft to the realtor, be sure you follow through. You can diarize in your calendar when other investments renewal dates are and ensure those renewals are handled properly. You should make yourself Mr. Pederson’s main financial contact.

Image generated using the prompt “Generate an Image showing the Advisor calling Mr. Pederson to follow-up on the situation,” sourced from OpenAI, 2025.

Summary

You do not need to fear client concerns or complaints… these situations can be gems to an advisor. They allow the client to see that you are highly capable when it comes to resolving situations and will encourage them to count on you for their future financial needs. They can help solidify your relationship with your client, and often the client will refer their friends and family members to you.

REFERENCES

CustomerThermometer. (n.d.) The Service Recovery Paradox. CustomerThermometer. Retrieved May 16, 2022.

EHL. (2020, June 19). Service Failures. 5 Basic Steps to Customer Service Recovery. hospitalitynet.

Mansfield, M. (2016, October 25). Customer Retention Statistics – The Ultimate Collection for Small Business. Small Business Trends.

Media Attributions

- Cust Serv Recov

- 3c414c24-1329-425b-9949-424bfa9b9e01

- c1e15859-93e7-4d3d-a564-d1e027c6a891

- a3a614d3-7f2c-44b0-b4d5-885bafccaeca

- 949b38ae-50f8-4563-a8d2-8dc44b775838

- 6f908c5a-69cd-4b9d-a4d1-d47a21e2e5b5

- Screenshot 2025-06-23 112517

- e32364e3-01af-49a0-af05-6a58e6c17645