1

Learning Objectives

LEARNING GOALS

Upon completion of this chapter, you should understand:

- the history of consumer credit, how it started, and how it has evolved over time.

- the different elements of consumer credit, including the different types of interest rates.

- the different sources of credit and where borrowers go to access credit in Canada.

- to gain insight into global types of credit from the client’s perspective by exploring diverse financial systems and practices beyond what is available in Canada.

- the reasons people need credit.

- the role of the lender.

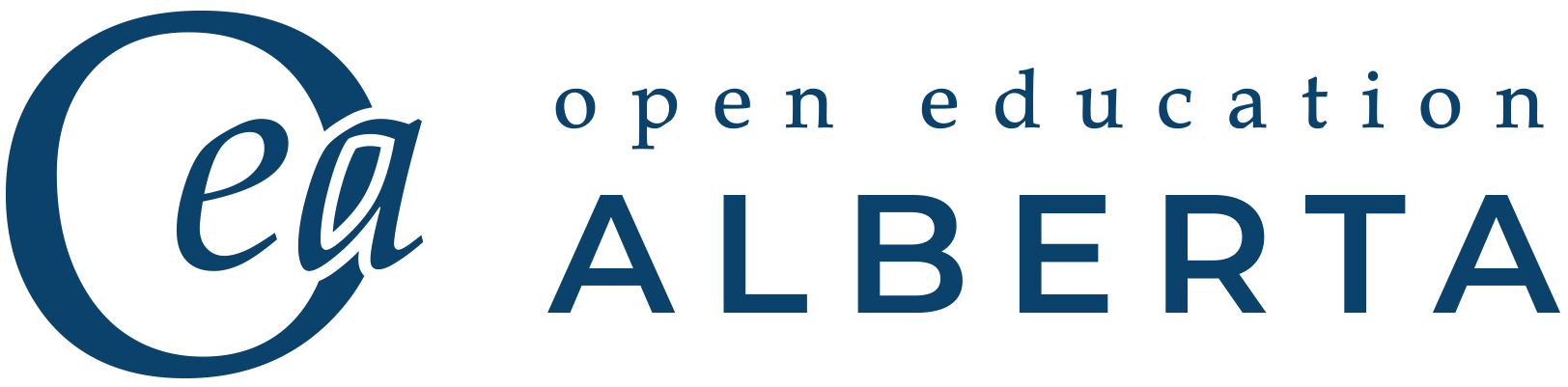

History of Consumer Credit

The practice of lending has been documented in history for thousands of years. In the beginning, it was rudimentary. Farmers used their seeds, grains, and livestock as repayment, which allowed them to borrow the funds they needed. Lending made it possible to transfer wealth from those with funds to those in need of funds. Lending fuelled and supported communities, which furthered growth and prosperity. From the simple to the complex (where we are today), the act of lending can still spur growth and wealth creation.

Jeff Desjardins states in his article The History of Consumer Credit in One Giant Infographic that consumer credit has existed for more than 5,000 years. Consumer credit can be dated to 3,500 BC, and it is thought that consumer loans were first used in Sumer (Desjardins, 2017).

Explore Desjardins’ article above to review in the link provided to review the history of lending practices! See where they began and how they have continued and evolved into what we see today.

Since these early beginnings, consumers have developed new attitudes and expectations surrounding credit. Consumers now see credit as both a necessity and a means to an end. Credit provides many benefits to consumers, benefits they would not enjoy without credit. Carrying a credit card around is much safer than carrying cash. If a credit card is lost, it can be replaced. The same can’t be said about cash. Credit allows consumers to make an immediate purchase rather than delaying the purchase and saving up. It provides that instant satisfaction society desires. In fact, most large items purchased by Canadians are purchased on credit. In 2017, 49% of large-ticket items were purchased on credit (Evans, 2017).

Credit is often used to purchase investments (i.e., shares, bonds, and real estate), allowing consumers to transfer earnings from their “later years” to the “earlier years” of their adult life. People incur the highest expenses of their lives in their early adult years as they break away from their parents and develop a residence and family of their own. Unfortunately, at this time, their income is usually the lowest it will be throughout their working career. In later years, they usually reach their peak levels of income while their major expenses diminish. The use of credit allows them to utilize future earnings when it is most required and repay it when their income is higher.

Interesting Facts about Canada’s History with Credit:

- 1946: Creation of the Canadian Mortgage and Housing Corporation (McAfee, 2006).

- 1960s–1970s: The first credit card was introduced into Canada. It was known as “Chargex” to Canadians (Mussio, 2022).

- 1961: Vancity Credit Union in British Columbia was the first Canadian financial institution to offer mortgage loans to women without a male co-signer (Nunnikhoven, 2018; Vancity, 2022). Until then, there were women who wanted or needed to buy property on their own, but they couldn’t.

Commercial Credit

Image generated using the prompt “create an image of Commercial Credit,” sourced from OpenAI, 2025.

(Commercial credit is briefly introduced here and will be discussed in more depth in subsequent chapters.)

Commercial credit deals with situations in which capital is needed by a business to meet its cash flow or long-term financing needs. Commercial credit can be less personal and often involves a longer process from the initial meeting to completion. These applications are typically much more in-depth and require additional oversight by the lender.

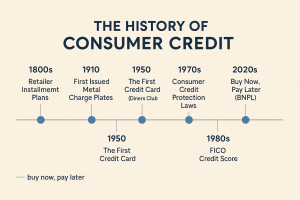

Trade Credit

Image generated using the prompt “create an image of Trade Credit,” sourced from OpenAI, 2025.

(Trade credit is briefly introduced here and will be discussed in more depth in subsequent chapters. )

Trade credit can be defined as credit granted by one business to another business. Trade credit is all unsecured lending, and the terms of the financing requirements are often very short term. With the unsecured lending element, requests for an extension of credit are scrutinized heavily by the lending business to ensure that repayment will be received.

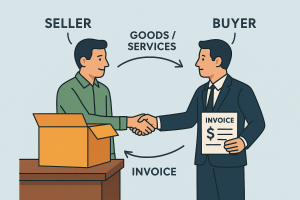

Introduction to Consumer Credit

Image generated using the prompt “create an image of Consumer Credit,” sourced from OpenAI, 2025.

Consumer Lending

Consumer lending can be defined as personal debt taken on to purchase goods and services (Kagan, 2021). It can also provide a cash requirement.

Understanding Consumer Lending

Consumer debt can be granted by banks and other debt-granting institutions. Receiving the needed funds allows a client to acquire assets immediately and repay that debt (plus the cost of interest) over time.

Understanding Interest and Its Place in Lending

Interest is the value applied to any debt that is advanced to a client; it is a monetary charge allowing the client access to these funds. Factors that affect the rate of interest applied to a debt by a lender are the following (Chen, 2022):

- the opportunity cost;

- the amount of expected inflation;

- the length of time the money is being lent;

- the possibility of government intervention on interest rates; and

- the liquidity of the loan.

The Types of Interest Rates

There are a variety of interest-rate options that a lender can apply to a loan. Typically, the type of interest rate applied is determined during a conversation a lender has with their client. Knowing the different types of interest rates and how they are applied can help the lender make the right recommendation to their clients.

Fixed rate versus Variable interest.

A client is buying a car and has agreed to a repayment term of 5 years. The loan officer indicates that the client can receive a fixed interest rate of 6%. This 6% rate will not change over the 5-year term. The loan officer also presents another option in the form of a variable rate interest rate of 5.5%. This rate does seem more attractive, but the rate is tied to the prime rate. In this example, we will say the prime rate is 5.0%. The bank charges an additional 0.5% on top of the prime rate. While the variable rate is lower, the risk to the client is if the prime rate increases, so will their interest rate to reflect the change. The prime rate could decrease, meaning the loan’s interest rate will decrease. Ultimately, the client will need to decide on what option they feel most comfortable with.

A fixed-interest rate is a rate that is assigned for a term. The rate will be applied for terms of 1, 3, 5, or 7 years. During the term of the loan/mortgage, the agreed-upon rate does not fluctuate in value. A lender may recommend a fixed rate to their client if they determine the client is risk-averse and would be uncomfortable in an environment of fluctuating interest rates or if the client prefers to know that their payment amount will not change over the course of the term, making it easier for them to budget.

PROS

- Market rate changes will not impact a borrower’s monthly payment; they will always know exactly what their payment will be.

- During periods when interest rates are rising, fixed rates do not change.

- For many loans, time frames for can be selected by the borrower; loans can range from 6 months to 10 year non-mortgage loans.

CONS

- Under fixed-rate agreement terms, loans are less flexible.

- During periods when interest rates decline, fixed rates do not change.

- Additional fees may be incurred if the borrower seeks to change the terms of the loan or exit the loan early.

- Historically, fixed-rate loans are more expensive over the life of the loan than variable rate loans.

[Table 1.1] The pros and cons of fixed interest rate loans (Source: Lee, 2022)

A variable-interest rate may sometimes be referred to as adjustable or floating. It is an interest rate that will fluctuate over the term of the loan/mortgage. The reason it fluctuates is because it is based on an underlying benchmark-interest rate or index that can change periodically (Lee, 2022). A lender would recommend a variable-rate interest to their clients when there is a low-interest rate environment.

PROS

- When interest rates fall, loan payments decrease.

- Variable-rate loans usually get superior upfront perks (i.e., lower introductory rates for an initial loan period.)

- A variable-rate loan commonly has a lower-interest rate than a fixed rate loan, primarily when the loan is incurred.

CONS

- When interest rates rise, the loan repayment will increase.

- If interest rates rise rapidly, a variable-rate loan can become more expensive than a fixed-rate loan.

- A borrower can face additional risk if they are already at repayment capacity or are overcapitalized.

- A borrower will have trouble determining what their future cash flow may be due to changing rates.

[Table 1.2] The pros and cons of variable interest rate loans (Source: Lee, 2022)

Is a Fixed or Variable Rate Better?

It comes down to what is better for the client. As demonstrated by the pros and cons of each type of interest rate, it is the responsibility of a lender to guide their client to the type of interest rate that will give them the best outcome from their perspective. If a lender were to offer a variable-interest rate for a client’s mortgage and then the client calls when they hear interest rates are rising and ask what they need to do, then clearly a variable-interest rate is not the type of rate best suited for them.

Lending Sources – Where Can Borrowers Find Sources of Credit?

Chartered Financial Institutions

Image generated using the prompt “create an image of Chartered Financial Institutions,” sourced from OpenAI, 2025.

Chartered financial institutions make loans to consumer clients and business clients that have met the institution’s requirements for access to credit. Financial institutions have a number of credit products they would offer to clients, including loans, mortgages, lines of credit, and credit-card accounts. In Canada, there are the “Big Six” chartered banks (Kagan, 2020):

- National Bank of Canada;

- Royal Bank;

- The Bank of Montreal;

- Canadian Imperial Bank of Commerce;

- The Bank of Nova Scotia (Scotiabank); and

- Toronto Dominion Bank (TD).

Credit Unions

Image generated using the prompt “create an image of Credit Unions” sourced from OpenAI, 2025.

Credit unions are nonprofit organizations/financial cooperatives that are controlled by members who have a common goal, which is providing access to funds that will help members achieve their financial goals. A credit union offers credit in a similar way to a chartered financial institution. However, a credit union may have different qualifying requirements compared to a chartered financial institution that could make it either more challenging or easier for someone to obtain financing. In Alberta, the largest credit union is Servus Credit Union, which dates back to 1938 (Servus Credit Union, 2022).

Sales Finance Companies

Image generated using the prompt “create an image of Sales Finance Companies,” sourced from OpenAI, 2025.

Sales finance companies offer services to finance big-ticket items, like automobiles, major appliances, furniture, and computer technology. A finance officer works with a client and helps them find financing so they can purchase the item they want/need. For example, a finance officer at a car dealership will take a client’s application and send it to multiple banks/lenders to find the best interest rate available to the client. Often, these rates are better than what a bank can offer.

Life Insurance Companies

Image generated using the prompt “create an image of Life Insurance Companies,” sourced from OpenAI, 2025.

Canadians who have a permanent insurance policy can borrow against the policy’s cash value for whatever needs they might have. Individuals who borrow from their insurance policy need to be aware that borrowing these funds might lower the amount of money their beneficiaries would receive at the time of the policyholder’s death or the amount the policyholder would receive if they chose to cancel the policy (Financial Consumer Agency of Canada, 2017). It is possible to borrow from a permanent insurance policy, but doing so can impact the amount of funds the beneficiary will receive.

Pawnbrokers

Image generated using the prompt “create an image of Pawn Brokers,” sourced from OpenAI, 2025.

While pawnbrokers are considered to be an unconventional form of lender, they are, in fact, a common source of secured loans for many Canadians. The pawnbroker holds an individual’s property and lends a portion of the property’s value to the individual. If the individual repays the loan and interest in the agreed-upon amount of time, the individual will receive their property back. Otherwise, the pawnbroker can sell the individual’s property to another customer. Typically, pawnbrokers charge higher rates of interest than other lenders.

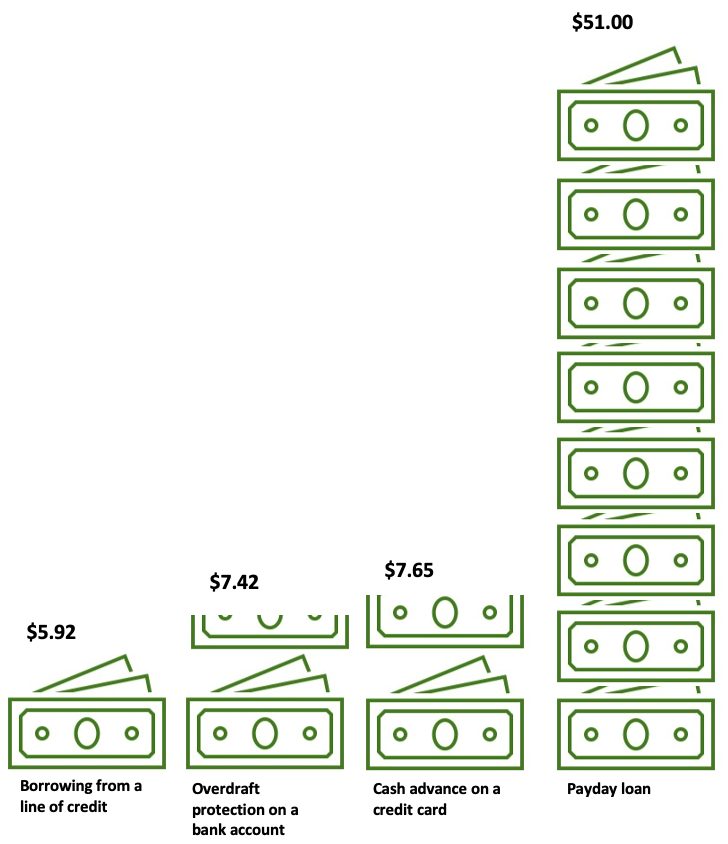

Payday Loans

A payday lender provides short-term loans with high fees to their customers. The setup for the customer is that they can borrow up to $1500 and then repay the funds from their next paycheque. In Alberta, customers have up to 62 days to repay the payday lender. These loans come at a high cost to the customer. Payday lenders charge high fees and high-interest rates (equivalent to an interest rate of 500% to 600%), and there may be charges if the customer’s pre-authorized debit does not have sufficient funds to cover what is owed (Financial Consumer Agency of Canada, 2020).

Figure 1.0 Illustrated here is the cost of a payday loan compared to a line of credit, overdraft protection on a chequing account, and a cash advance on a credit card (based on a $300 loan for 14 days). (Source: Financial Consumer Agency of Canada)

Family and Friends

Image generated using the prompt “create an image of Family and Friends,” sourced from OpenAI, 2025.

-

Microfinance

-

Community-Based Lending

- Islamic Finance

- Peer-to-peer (P2P) Lending

- Crowdfunding

- Informal Lending Networks

- Social Impact Bonds

- Social Credit

1. Microfinance

Image generated using the prompt “create an image of Micro Finance,” sourced from OpenAI, 2025.

Microfinance, or microcredit, refers to a specialized banking service catering to low-income individuals or groups, primarily in regions with limited access to traditional financial services. The aim of microfinance is to empower individuals and groups by providing them with opportunities to generate wealth and attain self-sufficiency (Investopedia, 2023). Microfinance institutions offer loans ranging from small amounts, as low as $50 to under $50,000, tailored to the specific needs of their clients (Investopedia, 2023). In addition to microcredit, these institutions may also provide a range of other banking services to support financial inclusion and economic development.

2. Community-Based Lending

Image generated using the prompt “create an image Community-Based Lending” sourced from OpenAI, 2025.

-

Profit-Sharing Contracts: Lender provides funds; borrower contributes expertise or labour. Profits and losses are shared based on a ratio (Mudarabah and Musharakah). (Hadizada & Nippel, 2022)

-

Murabaha: Lender buys an asset and sells it to the borrower at an agreed price with a profit margin. Repayment over an agreed period. (Financial Islam, 2023)

-

Ijarah: Lender leases the assets to the borrower for a specified period, predetermined rental payments. In ownership with a lender, the borrower enjoys the benefits and purchase options possible. (Blossam, 2020)

-

Istisna’a: Contract for financing construction or manufacturing of specific assets. The borrower makes payments during construction, and assets are delivered upon completion. (Law Insider, 2023)

4. Peer-to-peer (P2P) Lending

Image generated using the prompt “create an image Peer-to-peer lending” sourced from OpenAI, 2025.

Peer-to-peer (P2P) lending, also referred to as social lending or crowd lending, has emerged as a popular alternative method of obtaining loans directly from individuals, bypassing traditional financial institutions. P2P lending platforms, which have gained significant traction since their inception in 2005, connect borrowers and lenders, allowing them to engage in direct transactions without intermediary banks. (Investopedia, 2023). It is important to note that crowd lending is not the same as crowd funding, this will be discussed later on in this chapter.

-

Trust-based relationships: Reliance on trust, and social connections.

-

Flexibility: More flexible repayment terms than formal institutions.

-

Customized terms: Loan terms tailored to individual needs.

-

Limited documentation: Less reliance on formal paperwork.

-

Social cohesion and reputation: Reputation influences access to loans.

-

Local knowledge and understanding: Understanding of local dynamics and norms.

-

Emerging markets, particularly in rural areas and low-income communities.

-

Immigrant communities face barriers to formal financial services.

-

Informal economies with significant informal business activities.

-

Marginalized or underserved communities in both developed and developing countries.

-

Social and cultural organizations, religious groups, and community-based associations.

-

The government identifies a social issue and partners with an intermediary, like Social Finance, and reputable service providers to address it.

-

Social Finance coordinates with the government and provider to structure the project and raise funds from impact investors.

-

The provider delivers services to the target group, with Social Finance offering continuous support, including performance and financial management.

-

Delivering high-quality services significantly improves the lives of the target population.

-

An independent evaluator measures the project’s success using preset metrics. If successful, the government repays investors based on the level of outcomes achieved.

-

Convenience

-

Payment deferral

-

Income shortfalls

-

Debt consolidation

1. Convenience

Advantages

- Credit cards can have no interest charges when the outstanding balance is paid on time (not including cash advances).

- The monthly statement provides a convenient summary of expenses.

- Credit builds a person’s credit rating.

Disadvantages

- The interest rate charged on unpaid balances is often much higher than on other borrowed funds (some credit cards do have varying interest rates).

- Convenience can encourage impulse purchases, leading to an increased debt load.

- The convenience of credit encourages some people to accumulate excessive debt.

2. Payment Deferral

Advantages

- The opportunity to have goods/services immediately.

- It allows consumers to make reasonable purchases that exceed their current cash situation (e.g., car or house).

Disadvantages

- Purchases end up costing more because of interest and other charges.

- A repayment schedule reduces cash flow. Credit can reduce the ability to buy goods and services in the future.

3. Income Shortfalls

Advantage

- Credit allows clients to meet expenses during periods of little or no income.

Disadvantage

- Interest must be paid regardless of whether anticipated income is actually received.

4. Debt Consolidation

Advantage

- Combined payments result in lower interest costs, and combined payments free up cash flow for investment purposes.

Disadvantage

- Individuals with poor personal finance- management skills may consolidate their debts, but still incur additional debt.

The Role of the Lender

References

Media Attributions

- 5003e8ab-4a26-44a4-86a1-235da0848ed0

- 4cb1f663-f8ce-4855-8b24-468378ff99ab

- beb90328-2b21-49e0-9f6b-cddc77fb2a39

- 30cb0701-a667-455b-8756-62a0710ef323

- A clean, modern infographic-style image showing the logos and names of the six major chartered banks

- An artistic and symbolic image representing a credit union. The image should include visual elements

- An artistic and symbolic image representing sales finance companies. Include visual elements such as

- An artistic and symbolic image representing life insurance companies. Include visual elements such a

- ece896f7-da12-43b3-8813-598656d2eae5

- 306dedf2-0374-47c6-8616-91e3e85b99c0

- f73a47c1-3a29-431e-b88b-408d223ffb07

- download (1)

- download

- download (3)

- download (2)

- Screenshot 2025-06-26 123910

- Screenshot 2025-06-26 123940

- Screenshot 2025-06-26 123957

- image (5)