Chapter 1: Introduction to Canadian Payroll

1.3 What is payroll and why is it important?

1.3.1 Payroll Past and Present

Payroll—the process of administering pay, including deductions—has evolved significantly over time.

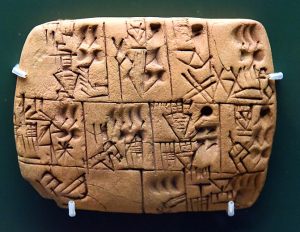

Some of the earliest recorded “documents” in human history are records of pay—cuneiform tablets from about 3000 BCE record workers’ pay in beer rations (British Museum, n.d.). Pay records and payroll have been kept in different forms through the ages.

Modern payroll is usually administered through payroll software. Growth is expected in this multibillion-dollar industry, as well as AI automation, and developments in cloud- and mobile-based applications (Vantage Market Research, 2022). One of the reasons for the shift towards software-based payroll is the increase in the complexity of payroll over time. Payroll administrators must follow many different legislative requirements (discussed in Chapter 2). These requirements vary from country to country and can vary within the same country. In Canada, payroll professionals will most likely need to be knowledgeable about both federal (Canada-wide) and provincial/territorial requirements, as well as changes that occur in every jurisdiction in which the organization operates.

1.3.2 The Responsibilities of the Payroll Function

Payroll is the process of calculating and distributing net pay to employees. It is a function that has either reported to HR or Finance, but can report to other areas in the organization such as Legal due the complex nature of the work. More specifically, payroll professionals are responsible for the following:

1. Verifying with management how much an employee is supposed to be paid and how often

2. Verifying a worker’s hours and/or timesheets with the worker and/or the worker’s supervisor

3. Calculating gross pay based on each employee’s hours worked and rate of pay

4. Adjusting for employees’ pay changes, lump sum payments, accruals (e.g., severance, personal days, and vacation days), sick days, and leaves of absence

5. Calculating and processing statutory holiday pay

6. Determining the withholdings that must be made from each employee’s gross pay, according to law (statutes and regulations), employer policies, and agreements made with the employee

7. Where applicable, deducting relevant insurance and/or benefit premiums from employees’ gross pay and remitting them to the appropriate recipients

8. Calculating each employee’s net pay after withholdings and any other deductions to gross pay

9. Determining and calculating employee net pay upon employee termination

10. Producing a record of employment (ROE) when an employee’s relationship with the organization has been terminated or interrupted for more than 13 weeks

11. Determining what payments, premiums, and contributions the employer must remit to the CRA or other government agencies (collectively called “employer payroll expenses”)

12. Calculating employer payroll expenses

13. Remitting the appropriate withholdings and employer payroll expenses to the CRA or other government agencies

14. Keeping records of each employee’s gross and net pay, including information about all withholdings and deductions (sometimes, the set of records for the whole organization is called “the payroll”)

15. Verifying each employee’s T4 information each tax year before T4s are issued

16. Annually updating the organization’s payroll processes and policies to reflect legislative and regulatory changes

References

Vantage Market Research. (2022, 15 July). $46+ billion global HR payroll software market is expected to grow at a CAGR of over 10.9% during 2022–2028. GlobeNewswire. https://www.globenewswire.com/fr/news-release/2022/07/15/2480383/0/en/46-Billion-Global-HR-Payroll-Software-Market-is-Expected-to-Grow-at-a-CAGR-of-over-10-9-During-2022-2028-Vantage-Market-Research.html

Image Credit

Clay tablet, beer for workers, late Uruk period, 3000–3100 BCE (British Museum, BM 140855) by Osama Shukir Muhammed Amin, FRCP, CC BY-SA 4.0